May Market Report - Weston Lakes

Weston Lakes Market Report – May 2025

Read time: ~7 minutes

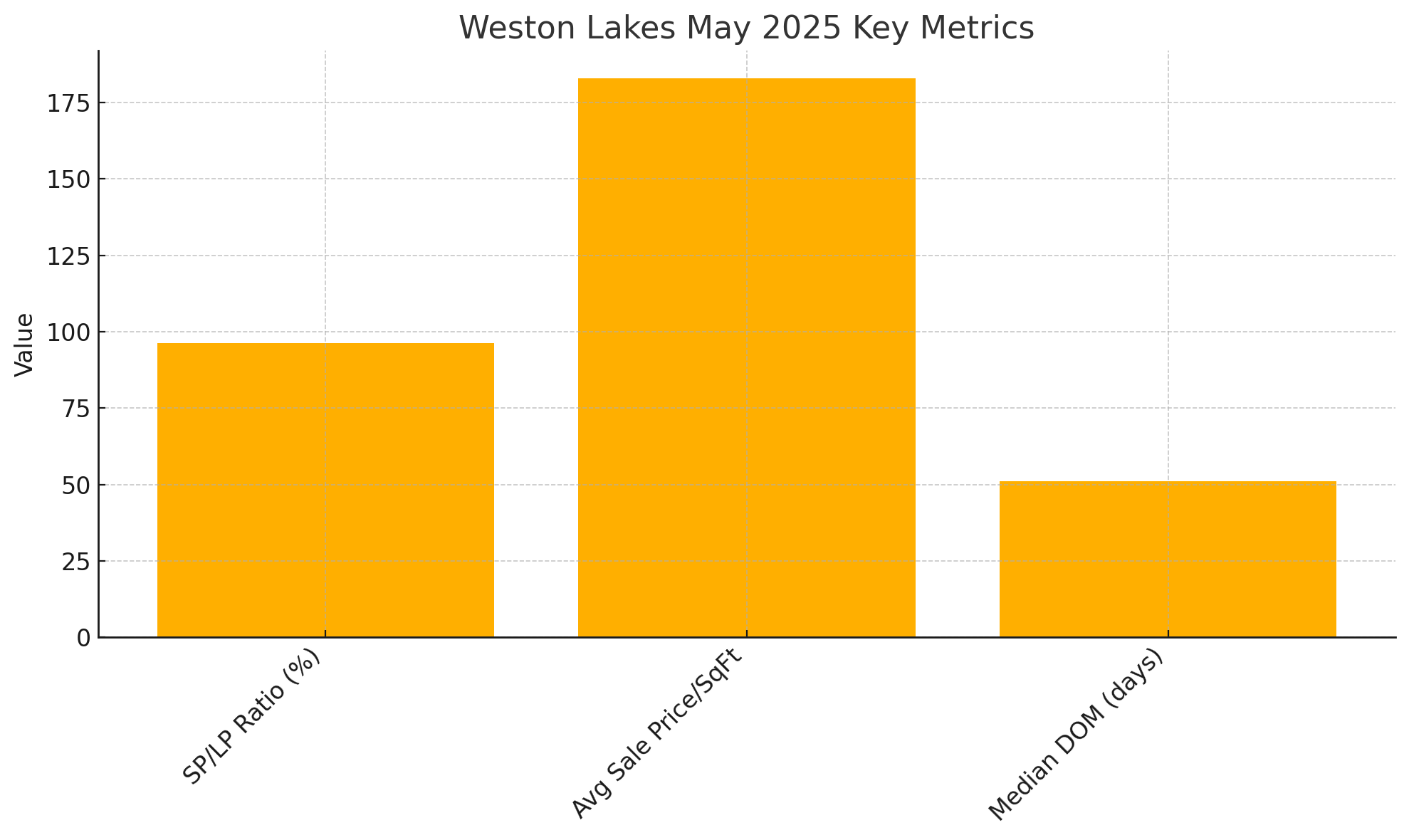

Key Metrics

| Metric | May 2025 Value |

|---|---|

| Average Sold Price | $650,800 |

| Avg SP/LP Ratio | 96.3% |

| Average Sale Price/Sq Ft | $183 |

| Homes Sold | 5 |

| Terminated Listings | 9 |

| Median Days on Market | 51 days |

| Fun Fact – Highest Sale | $985,000 |

1. SP/LP Ratio: A Pulse on Pricing

An SP/LP ratio of 96.3% tells us sellers are, on average, conceding 3.7% off their list price to close a deal. In my experience, anything above 95% indicates a relatively healthy market, but this dip from the low-to-mid 98% range we saw earlier this spring signals growing buyer leverage.

My Take: I see this as an opportunity for savvy buyers to negotiate with confidence—and a nudge for sellers to lean on precise, data-driven pricing strategies. Overpricing by even 2%–3% can stretch your days on market, so dialing in your list price is more critical than ever.

2. Days on Market: Trend Toward Patience

The median DOM of 51 days—up from roughly 45 days in April—reflects a market that’s cooling off its earlier frenzy. This lengthening timeline suggests buyers are taking more time to shop and negotiate, rather than making snap decisions.

-

Voice of Experience: When I see homes linger beyond 30 days, I recommend fresh photography, revisiting staging choices, or even a tactical price adjustment. Homes priced at market sweet spots tend to see renewed interest and accelerated offers.

3. Sales vs. Terminations: Reading Between the Lines

With 5 homes sold against 9 terminations, more listings exited the market unsold than closed. That ratio underscores a shift: buyers have more inventory to choose from, and sellers must work harder to differentiate their homes.

Agent Insight: Terminations often point to gaps in marketing or misalignment on price. When a home expires, it’s usually not for lack of demand—it’s for a misstep in presentation, price positioning, or both. In May, I guided two clients to revamp their marketing collateral mid-listing, resulting in offers within two weeks.

4. Price per Square Foot: Consistency Matters

An average of $183/Sq Ft continues to demonstrate solid per-foot value—especially for mid-sized homes between 2,200–3,500 Sq Ft. Larger estates generally trade at slightly lower PPSF but remain high in total sales price.

Neighborhood Nuance: In Weston Lakes, buyers value the lifestyle amenities as much as the home’s footprint. Proximity to golf, trails, and the country club often justifies premiums in PPSF—even when broader market forces soften.

5. Fun Fact: Top Closing at $985K

Our highest-priced sale in May closed at $985,000, a testament to what a well-priced, premium offering can achieve—even in a buyer-leaning market.

What Worked: That property featured professional video tours, twilight photography, and a limited-time incentive (closing credit), all of which created a sense of urgency and value.

6. Looking Ahead: Summer 2025

-

For Sellers:

-

Price Precisely: Use up-to-date comps and be prepared to tweak—don’t “set and forget.”

-

Refresh Your Brand: Mid-season is ideal for staging updates and new visuals.

-

-

For Buyers:

-

Lean In: Longer DOM and wider SP/LP buffers mean you can take time on inspections and still negotiate effectively.

-

Stay Ready: As inventory fluctuates, being pre-approved and responsive to new listings will keep you ahead.

-

Have questions or ready to plan your next move? Call or text me at 713-724-1685.

Thanks for reading—see you next month!

#WestonLakesLiving #BuyerMarket2025 #RealEstateInsights #FulshearTX

Categories

Recent Posts